PwC: Only 4% of executives say their businesses have successfully implemented AI.

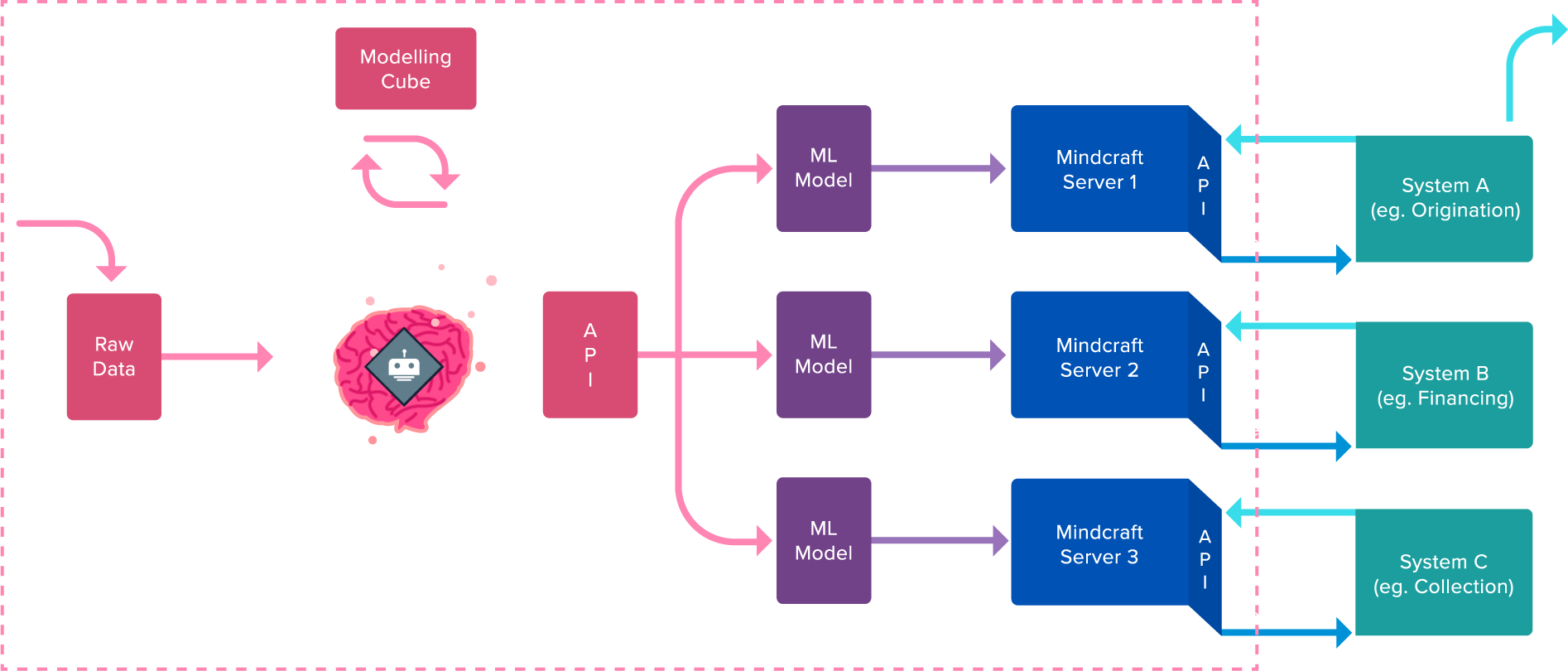

Coming up with a highly accurate predictive algorithm is one thing, but deploying it successfully is a whole other story altogether. Mindcraft can automate this entire process for you!

We built Mindcraft to solve three key problems that plague our customers

1

To simplify AI deployment for everyone.

2

To pick the best combination of algorithms that work together to solve your problems.

3

To ensure the AI is learning continuously.

Deep dive into what Mindcraft can accomplish for you

What Mindcraft can do for your business

Enhance and accelerate existing solutions.

Want to collect debts more efficiently, predict delays for your airline, or make better trade decisions? Regardless of your needs, Mindcraft works with existing solutions, helps achieve better results, and ensures customer satisfaction.

Exponentially improve data scientist productivity.

Mindcraft automates repetitive and complex data science tasks so your data scientists are free to spend more time on higher-level planning and strategic thinking.

Transform novice users into citizen data scientists.

It is hard to find competent data scientists. Especially ones who have in-depth knowledge of your specific business domain. With Mindcraft, you can transform your business experts into citizen data scientists.

Drive tangible results with the power of Mindcraft.

Hype in the market about AI has resulted in many skeptics. Mindcraft’s proven technology is already in use by major banks for credit scoring, early warning, and identifying self-curing customers for over a decade.

Core functionalities

Integrated credit application

Everything from credit origination to credit scoring, limit determination, approval process workflow, and disbursement.

Calculate a customer's propensity

Calculate the likelihood of a customer buying an offering or product based on his/her past transactions and CRM behaviour.

Digital marketing strategy

Use Mindcraft's predictive abilities to identify digital marketing strategies that are most likely to generate conversion.

Customer acquisition

Mine data from social networking sites to identify and acquire customers that are similar to your existing ‘high profitability potential’ customers.

Versatile scoring engine

Allows you to combine your business expertise with statistical credit risk measures.

Freedom to build scorecards

Give user the freedom to build scorecards from expert rules, artificial intelligence, and statistical methods.

Balance risk against profit

Help Credit Manager to balance risk against profit pursuit, increasing operational efficiencies.

Speed up credit evaluation

State-of-the-art approval workflow engine speeds up credit evaluation and approval process.

Multi-tier scoring approach

Supports hierarchical scoring and in-segment scoring.

Integration to external rating systems

Seamless integration with CCRIS and CTOS.

Fully web-based

Fully web-based for easy deployment plus lower maintenance and operating costs.

Integrate with credit bureaus of other countries

For international users, we can seamlessly integrate Mindcraft with the credit bureaus in your country.